TI’s Stock Is Outperforming Again — What That Says About the Analog & Embedded Rebound

As the AI spotlight burns bright, a quieter rally is building in embedded and analog semis. Here’s why investors are starting to pay attention.

As the AI spotlight burns bright, a quieter rally is building in embedded and analog semis. Here’s why investors are starting to pay attention.

While Wall Street remains transfixed on AI megatrends, Texas Instruments (TI) is quietly flexing its strength. The company’s Relative Strength (RS) rating recently climbed into the low 80s, a hallmark of technical momentum among top-performing stocks (investors.com). This uptick parallels similar moves in ON Semiconductor (RS 81) (investors.com) and Analog Devices (RS 77) (investors.com), signaling a deeper undercurrent: analog and embedded semiconductors are staging a quiet comeback, even as AI accelerators steal the limelight.

The question for investors is whether this is merely a technical rotation or a broader structural shift. With TI’s legacy in long-cycle markets, its recent moves deserve a closer look.

Why Analog is quietly leading again

Analog semiconductors remain foundational to the physical world. These chips regulate power, interpret real-world signals, and are essential to systems across automotive, industrial, healthcare, aerospace, and energy sectors. Unlike digital ICs, which may become commoditized quickly, analog designs benefit from longer design-in cycles, deeper customer lock-in, and better pricing durability.

TI’s position is uniquely fortified by vertical integration. The company is investing $60 billion into domestic fabs, including four 300 mm lines in Sherman, TX, and two more in Richardson and Lehi, UT (Texas Instruments plans to invest $60B in semiconductor fabs) . It recently secured $1.6 billion in CHIPS Act funding to accelerate this strategy (The US finalizes CHIPS Act funding for Samsung and Texas Instruments).

This fab-centric model gives TI tight cost control, greater agility during supply shocks, and insulation from geopolitical tension, a clear differentiator in a world where design wins can span a decade. TI’s pricing power is not simply a function of innovation. It is enabled by ownership of the supply chain.

Embedded Systems: AI’s silent infrastructure

Analog may be the nervous system, but embedded controllers are the muscle. TI’s strength lies in combining both into a stack optimized for edge deployment.

Embedded processors and microcontrollers enable smart energy grids, robotics, automotive control systems, and factory automation. As AI models begin to push toward inference at the edge, where latency and power are critical, embedded silicon becomes pivotal.

TI’s product portfolio spans embedded CPUs, analog signal chains, and power ICs, creating pre-integrated solutions that appeal to industrial OEMs. This edge orientation is strategic: it offers less cyclical volatility, longer product lifetimes, and defensible margins. As digital peers race to release the next transformer model, TI is quietly capturing billions of touchpoints downstream.

Who else is catching the wave?

This resurgence isn’t isolated. It reflects a broadening interest in the “old-school” semis that build physical infrastructure.

ON Semiconductor (RS 81) has surged on demand for power ICs and image sensors in EVs and autonomous vehicles (investors.com).

Analog Devices (RS 77) continues to benefit from design momentum in industrial signal processing (investors.com).

Microchip (RS 72) is riding investor confidence in its microcontroller and connectivity portfolios (inkl.com).

NXP (RS 75) is seeing renewed traction in automotive and RF secure communications (investors.com).

Outside the US, STMicroelectronics is capitalizing on European auto and industrial investments, while Renesas continues to supply high-reliability analog and MCU components into the automotive and computing sectors. Both serve as key indicators that this rebound is not just domestic, but global.

Margin Power and Fab Control: A comparative edge

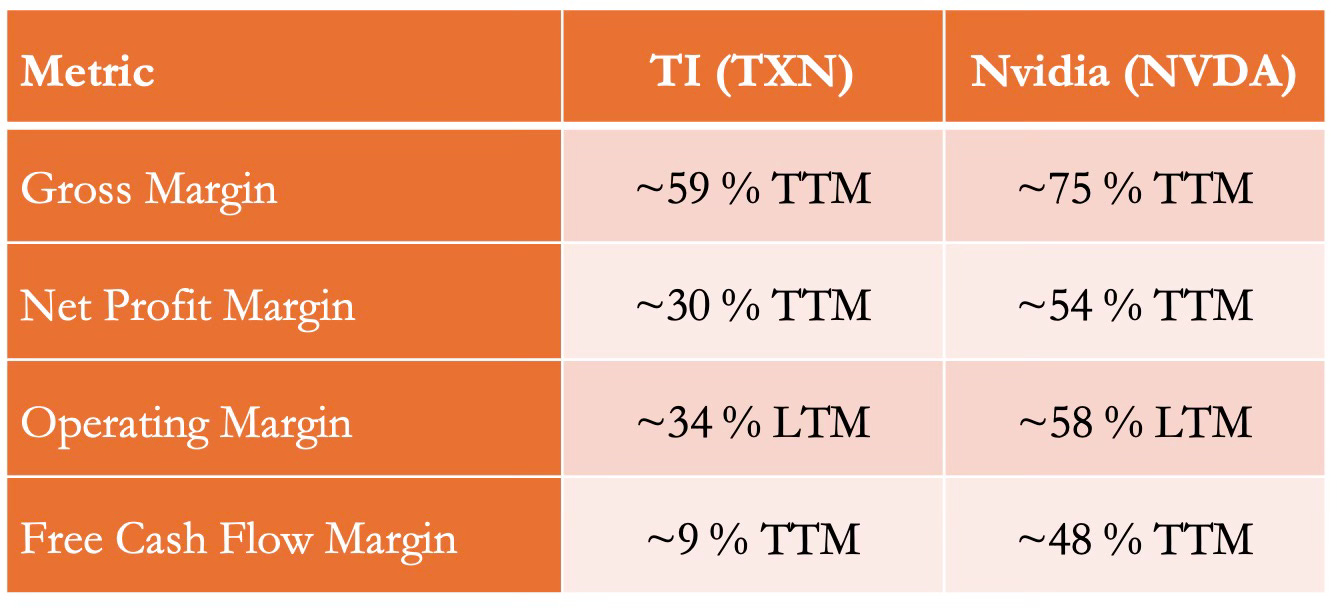

To fully grasp TI’s value proposition, compare its profitability to the sector’s flagship AI player, Nvidia:

TI’s gross margin is best-in-class among analog players, thanks to owning its fabs and avoiding foundry markups. While Nvidia’s profile remains unmatched, TI’s margin stability and fab leverage make it a standout in the embedded world.

Analog Devices operates on a hybrid model with less manufacturing ownership, which can hinder margin consistency when capacity tightens. ON Semi, meanwhile, is gaining scale but remains more exposed to cyclical pricing. TI’s edge lies in its vertically integrated supply chain and customer diversity across 100,000+ clients.

Strategic takeaways for investors

Counter-cyclical durability: Analog and embedded aren’t tied to hyperscaler capex budgets. They thrive on auto production, factory retooling, energy modernization, and defense – all secular, policy-backed sectors with multi-decade budgets.

Value through vertical control: Owning fabs gives TI superior cost visibility and inventory flexibility. In a bifurcated world, fab ownership becomes a geopolitical asset, not a cost center.

Rerating potential: Stocks registering RS ratings over 80 often anticipate broader upgrades. TI’s move toward technical leadership mirrors early phases of secular stock rotation. Embedded and analog names are no longer just yield proxies. They’re being repositioned as strategic compounders.

Watch points: TI’s size means it is more exposed to macro softness in automotive and industrial capex. Capital intensity is high, and fab utilization remains critical. Margin stability can erode if end markets falter, especially in autos or smart energy systems.

Forward-looking indicators

What to watch next:

OEM order momentum: Watch for continued momentum in industrial and automotive demand. Order lead times and revised build schedules are key leading indicators of revenue quality.

Factory utilization: TI’s margin leverage only works if fabs remain well-loaded. If demand slackens, fixed fab costs can pressure profitability.

Policy tailwinds: CHIPS Act allocations and equivalents in Europe and Japan are increasing their focus on analog fabs and microcontroller production. Germany and India are both offering substantial subsidies to analog-heavy projects, and that could shift global capacity maps.

Investor rotation: Institutional investors are starting to pivot from high-beta growth into stable compounders. The analog names may offer not only safety, but also optionality.

Bottomline: In the AI Storm, Analog Anchors provide stability

The spotlight is on GPU scale and AI training throughput. But as compute moves closer to the edge and AI enters the real world, analog and embedded chips become the enablers. Texas Instruments and peers are no longer just margin machines; they are now strategic anchors in system design.

For institutional investors, semiconductor strategists, and industry executives, the time to pay attention is now. These sectors may not flash across CNBC tickers, but they are the scaffolding of intelligent infrastructure, and the cash flows may speak louder than the hype.

Moreover, this is not merely a safe-haven rotation. The analog and embedded domain is in the early innings of what could be a multi-cycle revaluation. Demand is increasingly shaped by national policy, electrification trends, and edge compute proliferation – all long-term, structural forces. In many ways, this segment resembles the industrials of the semiconductor world: durable, cash-rich, and irreplaceable, even when out of the spotlight.

As investors continue to chase AI narratives, those with the foresight to look beneath the stack may find strategic clarity and capital efficiency in analog and embedded. The challenge, and opportunity, is knowing where the quiet strength lies.

Note: This post is for informational purposes and does not constitute investment advice.